Tax Audit: The Question Is "When," Not "If"

The Tax Administration has the right to audit any taxpayer. Audits can cover a period of up to 5 years back. When the inspector arrives, they ask for documents. Fast. If you don't have an organized system — panic begins.

What Tax Audits Typically Request

- All incoming and outgoing invoices for the audited period

- Bank statements matching the invoices

- Contracts underlying the invoices

- Delivery notes as proof of goods delivery

- VAT records

- Payroll calculations

- Import calculations

The inspector expects everything to be available within hours, not days.

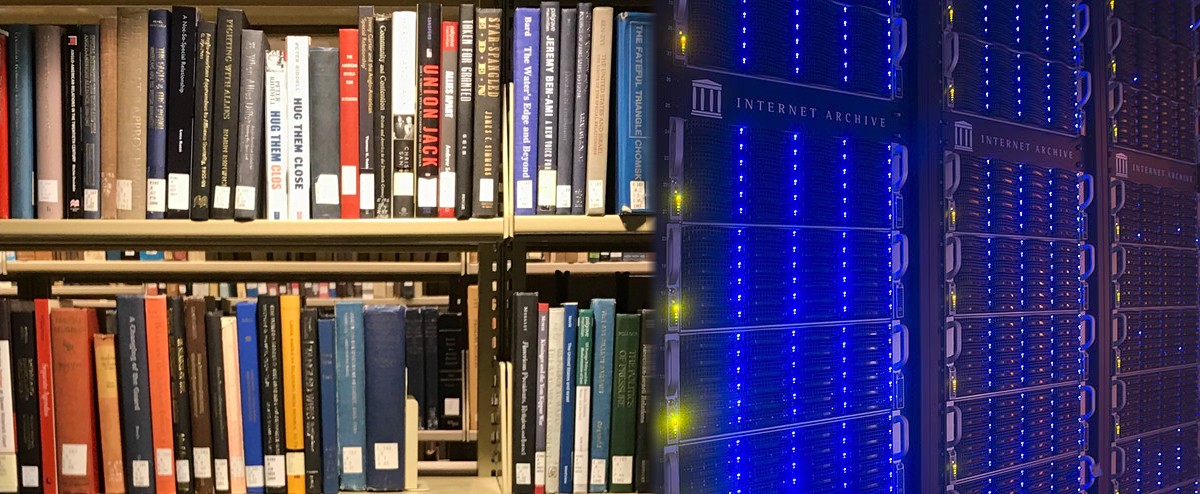

The Solution: Organized Digital Archive

With a DMS system, audit preparation looks like this:

- Inspector requests invoices from supplier X for 2024

- You search: "invoices supplier X 2024"

- System displays all invoices — organized chronologically

- Export to PDF or print

- Time: 30 seconds

Cost of Being Unprepared

- Fines for not producing documents: 100,000 — 2,000,000 RSD

- Inspector can estimate your tax base — always to your disadvantage

- Interest on tax differences for all audited periods

Conclusion

A tax audit isn't a question of "if" but "when." The only protection is an organized system with all documents accessible in seconds.

Arhivix stores all business documents organized by type, client, and period. When an audit comes — any document is accessible in seconds. Sign up free.