Introduction: Electronic Invoicing in Serbia

In 2022, Serbia launched the Electronic Invoice System (SEF) as a centralized state platform for issuing, sending, receiving, and storing electronic invoices. Since January 2023, using the SEF has been mandatory for all VAT payers in the private sector.

The goal of the system is the complete digitalization of invoicing, reduction of tax fraud, and automation of business processes. Instead of paper invoices, PDFs, or emails, all invoices pass through a unified state system in a structured XML format.

What Is SEF (Electronic Invoice System)?

SEF is the central platform of the Ministry of Finance of the Republic of Serbia for electronic invoicing. It was developed as a mandatory system through which all invoices between business entities must pass.

Key features of the SEF system:

- Structured XML format enabling automatic processing

- Unique identification number for each invoice

- Automatic verification of data accuracy

- Invoice storage for a minimum of 10 years (5 years for non-VAT payers)

- Electronic signature or certificate for registration and access

Who Must Use SEF?

The obligation to use the SEF system depends on the type of entity:

Mandatory since January 2023:

- All VAT payers in the private sector (B2B transactions)

- Public sector entities (state institutions, public enterprises)

- Private sector to public sector (B2G transactions)

Also mandatory for:

- Non-VAT payers who invoice the public sector

- All entities that receive invoices from VAT payers

The only exception is individuals who do not conduct business activities and small entrepreneurs who are not in the VAT system and do not do business with the public sector.

How Does SEF Work in Practice?

The electronic invoicing process through SEF works as follows:

- Creating the invoice in your accounting software or directly on the SEF portal

- Sending through SEF in the prescribed XML format

- Automatic verification of data by the system (tax ID, amount, VAT)

- Assignment of a unique number and issue date

- Receipt by the buyer through the SEF system

- Acceptance or rejection of the invoice by the recipient

- Permanent storage in the system (minimum 10 years)

Deadlines for Receiving and Accepting Invoices

| Action | Public Sector | Private Sector |

|---|---|---|

| Deadline for acceptance/rejection | 15 days | 15 days |

| If no response | Considered accepted | Considered rejected |

| Deadline for VAT recording | 12 days from end of tax period | 12 days from end of tax period |

What Changes from 2026?

The Law on Electronic Invoicing was amended at the end of 2025, and the most important changes take effect during 2026:

From March 2026:

- Mandatory internal invoices generated directly in SEF (for existing system users)

- Electronic invoicing for retail in certain cases

- B2G electronic delivery notes become mandatory for the private sector

From late 2026 / early 2027:

- Pre-filled VAT returns based on data from SEF

- Automatic reconciliation of incoming and outgoing invoices

- Greater automation of tax obligations

Benefits of Electronic Invoicing

Switching to electronic invoices brings concrete benefits:

- Savings of up to 80% in costs compared to paper invoicing

- Elimination of errors from manual data entry

- Faster payment process as the invoice arrives instantly

- Automatic storage without physical archive space

- Easier oversight and review of all issued and received invoices

- Legal compliance without additional administrative work

Penalties for Non-Compliance

Failure to meet electronic invoicing obligations carries penalties:

Penalties for legal entities: 200,000 to 2,000,000 RSD

For entrepreneurs: 50,000 to 500,000 RSD

For responsible persons: 50,000 to 150,000 RSD

Penalties apply for: not issuing an e-invoice within the prescribed deadline, failure to register in the SEF system, not accepting an invoice within the legal deadline, and non-compliance with the XML format.

How Does Arhivix Help with Electronic Invoices?

Arhivix is designed to simplify your work with electronic invoices as much as possible and align your business with the law. Here is how:

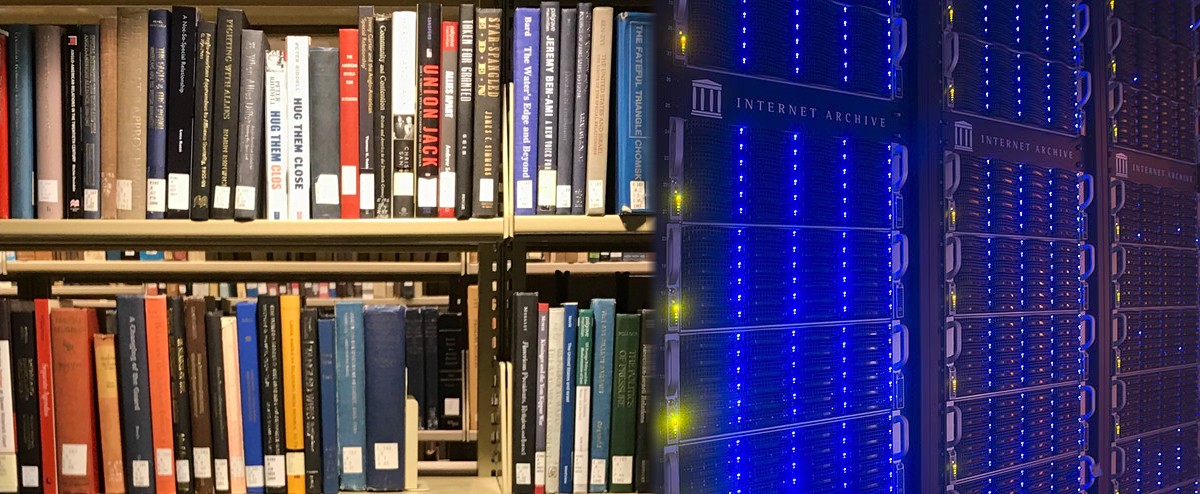

Automatic Archiving of E-Invoices

Every electronic invoice that passes through your system is automatically archived in Arhivix. No manual file transfers, no copying. The invoice is saved, organized, and accessible whenever you need it.

Natural Language Search

Forget about digging through folders. Type "invoice from supplier X from March" and Arhivix AI will find the exact document in seconds. The system understands the context and content of every invoice.

Automatic Tagging and Categorization

AI automatically recognizes the invoice type, supplier, amount, date, and assigns appropriate tags. Without any effort on your part, invoices are organized from the very first moment.

Legal Compliance

Arhivix stores invoices in accordance with legal requirements for a minimum of 10 years. Storage across two AWS European regions, AES-256 encryption, complete audit trail.

Integration with the Archive Book

Invoices are automatically recorded in the digital archive book. When an inspection requests access, everything is ready in a single click.

Conclusion

Electronic invoicing in Serbia is no longer optional but mandatory. The SEF system brings transparency and efficiency, but also requires technical preparation. With Arhivix, the entire process is automated: from invoice receipt, through archiving, to search and inspection reporting.

Instead of adapting to the system, let the system adapt to you. Try Arhivix free for 14 days.