Why Document Retention Periods Matter

Every business is legally required to keep certain records for a specific number of years. Destroying documents too early can lead to fines, audit failures, and loss of legal protection. On the other hand, keeping everything forever creates unnecessary clutter and costs.

Knowing exact retention periods helps you:

- Stay legally compliant

- Automate deletion/archiving of old documents

- Save storage space (physical and digital)

- Be prepared for tax audits and inspections

Document Retention Schedule

Financial Records

| Document Type | Retention Period | Legal Basis |

|---|---|---|

| Annual financial statements | Permanent | Companies Act / GAAP |

| General ledger and journals | 7 years | Tax regulations |

| Sales and purchase invoices | 7 years | VAT / Tax Code |

| Bank statements | 7 years | Tax regulations |

| VAT returns | 7 years | VAT Act |

| Corporate tax returns | 7 years | Tax Code |

| Expense receipts | 7 years | Tax regulations |

| Payroll records | 7 years | Employment law |

Employee Records

| Document Type | Retention Period | Legal Basis |

|---|---|---|

| Employment contracts | 6 years after termination | Employment law |

| Pension records | Permanent | Pension regulations |

| Time sheets / attendance | 3 years | Working Time Directive |

| Health & safety records | 40 years | H&S regulations |

| Training records | Duration of employment + 3 years | Best practice |

Commercial and Legal Documents

| Document Type | Retention Period | Legal Basis |

|---|---|---|

| Articles of incorporation | Permanent | Companies Act |

| Client/supplier contracts | 6 years after expiry | Limitation Act |

| Delivery notes | 6 years | Sale of Goods Act |

| Purchase orders | 6 years | Commercial law |

| Planning permissions | Permanent | Planning regulations |

| Insurance policies | Permanent (while active + 6 years) | Insurance law |

What Happens If You Destroy Documents Too Early?

Consequences can be severe:

- Tax penalties — HMRC/IRS can impose fines and estimate your tax liability

- Inability to prove your position in court or during an audit

- Loss of tax deductions — no invoice means no VAT reclaim

- Regulatory sanctions — industry regulators may take action

How to Automate Retention Periods

Manually tracking retention periods for thousands of documents is an impossible task. A DMS like Arhivix can:

- Automatically assign retention periods based on document type

- Send alerts before a retention period expires

- Suggest archiving or deletion of documents past their retention period

- Generate reports on documents by retention period

- Prevent premature deletion by locking documents

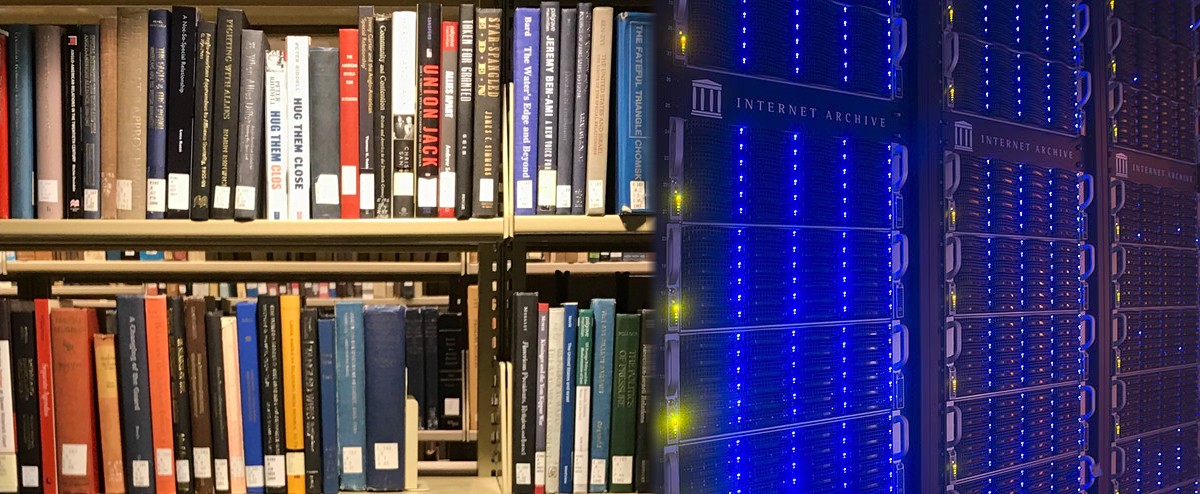

Digital vs. Paper Storage

In most jurisdictions, digital copies now have the same legal validity as paper originals, provided they meet certain requirements (integrity, authenticity, readability). This means you can:

- Scan paper documents and store them digitally

- Destroy paper originals after digitization (following proper procedure)

- Use electronic invoices instead of paper

Digital storage is not only legal — it's cheaper, more secure, and more practical.

Conclusion

Retention periods aren't optional — they're a legal requirement. Deleting too early costs fines; keeping too long costs space and resources.

Arhivix automatically tracks retention periods for every document and notifies you when it's time to archive or delete. You never have to manually track deadlines again.