General Questions

1. What are e-delivery notes?

Electronic documents tracking goods movement from sender to recipient, replacing paper delivery notes through a central government system.

2. When are they mandatory?

From January 1, 2026 for public sector and excise goods. From October 1, 2027 for the entire private sector.

3. Are e-delivery notes the same as e-invoices?

No. E-invoices go through SEF for billing. E-delivery notes go through a separate system for tracking physical goods movement. Two separate systems.

4. Do I need both an e-invoice and e-delivery note?

Yes. E-invoice for the financial flow, e-delivery note for the physical flow.

Registration and Access

5. Where do I register?

At eotpremnica.mfin.gov.rs. A DEMO environment exists for testing.

6. What certificate do I need?

A qualified electronic certificate — the same used for e-invoices on SEF.

7. How much does the portal cost?

The portal is free. You only pay for the electronic certificate and optional integration software.

Sending and Receiving

8. Who creates the e-delivery note?

The sender. Must be created BEFORE goods leave the warehouse.

9. What are the recipient's deadlines?

3 days for physical receipt confirmation + 8 days to accept or reject.

10. What if the recipient doesn't confirm?

The recipient is in violation — fine up to 500,000 RSD. The sender is not responsible.

Technical Questions

11. What if there's no internet?

Use the paper version with hologram sticker. Print 3 copies and enter into the system when internet returns.

12. Can I integrate with my ERP?

Yes. The portal offers a REST API for programmatic integration.

13. Do I need special software?

No — the web portal is free. But for 5+ daily delivery notes, ERP/DMS integration is recommended.

Penalties

14. How much are the fines?

From 50,000 to 2,000,000 RSD depending on the violation.

15. Does the grace period mean I don't have to do anything until July?

No! The grace period only covers data errors. Complete non-use is still a violation.

Archiving

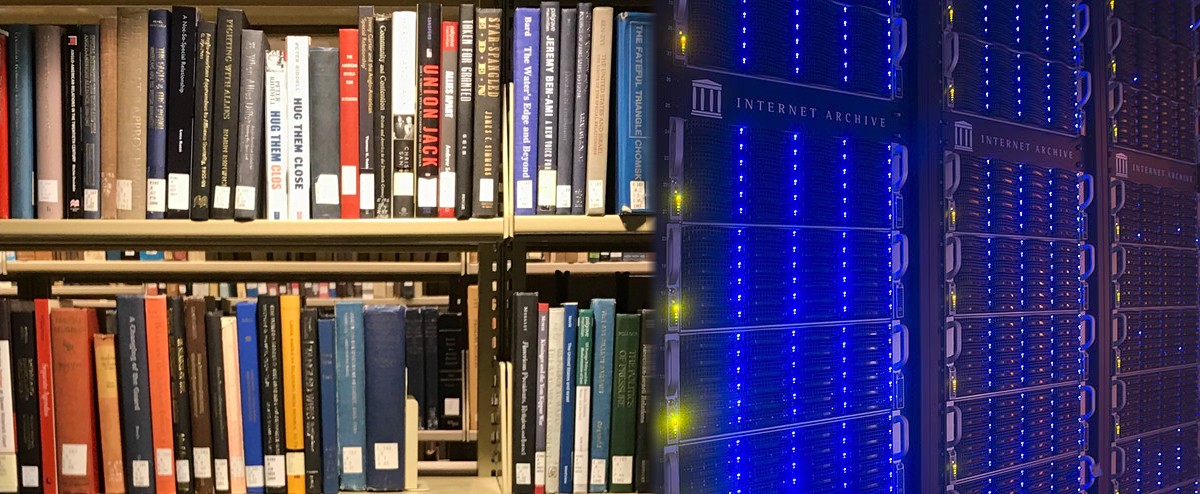

16. How long must I keep e-delivery notes?

Minimum 10 years (private sector). Public sector — permanently.

17. Is the portal storage enough?

Legal responsibility for storage is on YOU. Keep your own copy in a DMS or ERP.

Specific Situations

18. What about courier services?

The courier is the carrier — they must have access to the e-delivery note during transport. You create it, they see it in MATP.

19. Do e-delivery notes apply to services?

No. Only for physical goods movement. Use e-invoices through SEF for services.

20. Can I cancel an e-delivery note?

You can void it before goods depart. Once goods are in transit, it cannot be deleted.

Conclusion

E-delivery notes are Serbia's new business reality. The system isn't complicated but requires preparation. Register, test on DEMO, and be ready before the grace period ends.

Arhivix answers all these questions in practice — integrates e-delivery notes into your DMS, automates sending and receiving, archives for 10+ years, and keeps you compliant. Try it free.