Excise Products: Strictest E-Delivery Note Requirements

While most of the private sector has until October 2027, companies working with excise products are obligated from January 1, 2026. This includes every movement of fuel, alcohol, coffee, and tobacco — without exception.

Which Products Are Classified as Excise?

- Petroleum derivatives — gasoline, diesel, heating oil, LPG

- Alcoholic beverages — beer, wine, spirits

- Coffee — raw, roasted, instant, extracts

- Tobacco products — cigarettes, smoking tobacco, nicotine e-cigarettes

- Biofuels and biolubricants

Who Is Obligated from January 1, 2026?

| Participant | Obligation |

|---|---|

| Manufacturer | Creates e-delivery note for every shipment |

| Distributor/wholesaler | Receives and sends e-delivery notes |

| Retailer | Receives e-delivery notes for incoming goods |

| Carrier | Has access to e-delivery note during transport |

| Importer | Creates e-delivery note when releasing from customs |

Why Is the Regime Stricter for Excise Products?

1. Real-Time Tracking

For excise products, the system enables real-time tracking. Inspectors can check at any moment where goods are and whether a valid delivery note exists.

2. Link to Excise Stamps

E-delivery notes for excise products can be linked to the excise stamp system. Each shipment of cigarettes or alcohol must match between the delivery note and excise stamp count.

3. More Frequent Inspections

Although penalties are formally the same, inspection of excise products is much more frequent. Road transport inspection, customs, and tax authorities actively control excise goods transport.

Practical Examples

Fuel Distributor

Sends tanker trucks with diesel to a gas station: creates e-delivery note with exact fuel quantity, includes vehicle and driver data, gas station confirms receipt — quantities are cross-referenced.

Coffee Importer

Releases goods from customs warehouse: creates e-delivery note when leaving customs, includes coffee type, quantity, and customs document number.

Common Mistakes

- Creating the note after departure — must be BEFORE departure

- Incorrect quantities — discrepancy between note and actual quantity raises red flags

- Missing carrier data — mandatory field for excise products

- Recipient not confirming receipt — leaves the note "open"

- No paper backup ready — when internet fails, goods cannot move without the hologram version

Conclusion

Companies handling excise products face the strictest oversight and must be ready from day one — January 1, 2026. The grace period exists for data errors only, not for non-compliance.

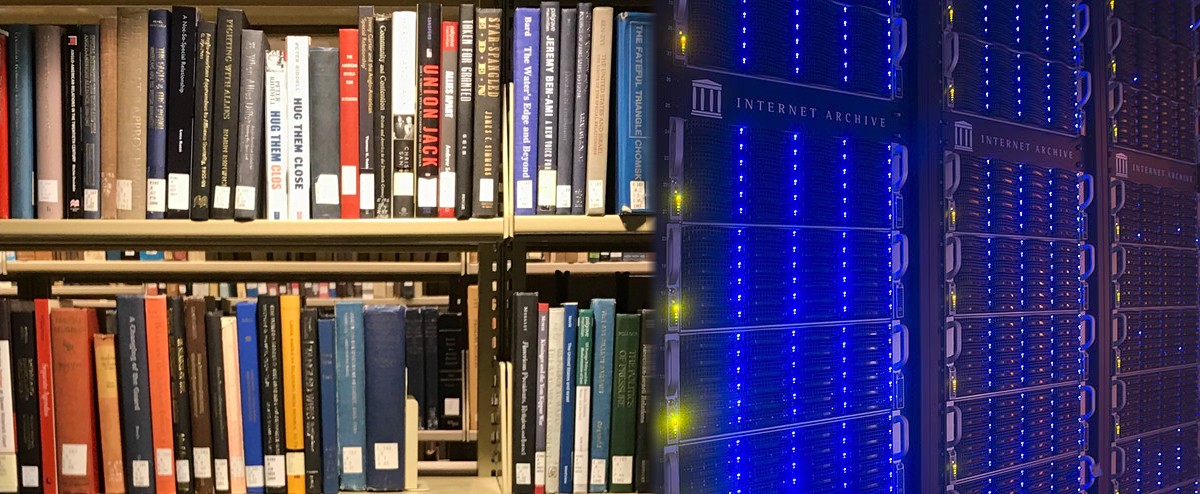

Arhivix integrates e-delivery notes into your DMS — automatic creation from orders, linking with invoices, and 10+ year archiving. Inspection-ready from day one.