How Long Must You Keep E-Delivery Notes?

| Entity Type | Retention Period |

|---|---|

| Public sector | Permanently |

| Private sector | Minimum 10 years from date of issue |

What Exactly Must You Keep?

- E-delivery notes — all sent and received

- E-receipt notes — all confirmations

- Paper versions with hologram — if used during outages

- Audit trail — who created, modified, confirmed

- Attachments — photos, CMR, quality certificates

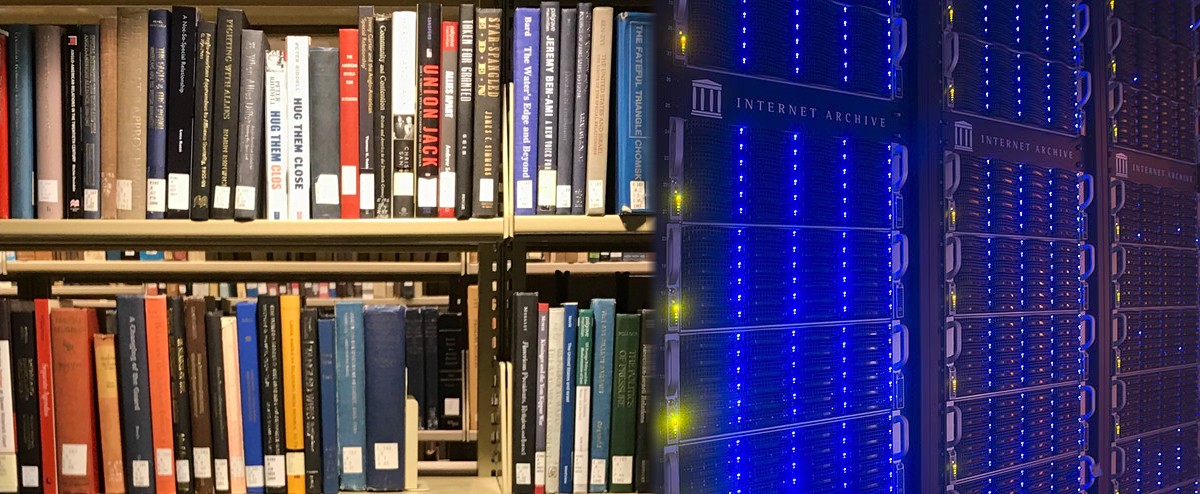

Where Are E-Delivery Notes Stored?

1. Central System (Portal)

The portal stores all notes centrally, but relying solely on it is risky — the law places responsibility on YOU.

2. Your Own System (Mandatory)

You must have your own copy. Options: DMS (recommended), ERP archive, or file system.

Why DMS for Archiving?

- Automatic classification — by recipient, date, goods type

- Guaranteed retention — prevents accidental deletion

- Document integrity — hash values, digital signatures, audit trail

- Cross-linking — connects delivery notes with invoices, receipt notes, contracts

What Inspectors Look For

- Do you have all delivery notes?

- Are they searchable?

- Are they unmodified?

- Do you have an audit trail?

- Do you have backups?

Archiving Checklist

- DMS or ERP with long-term archiving

- Auto-sync with the e-delivery notes portal

- Off-site backup (cloud or physical)

- Retention periods configured (10 years / permanent)

- Deletion protection (retention lock)

- Search by recipient, date, goods type

- Audit trail enabled

- Linked with e-invoices and receipt notes

Conclusion

Archiving e-delivery notes isn't optional — it's a legal requirement for 10 years. Don't rely solely on the government portal.

Arhivix automatically archives all e-delivery notes for 10+ years, with full search, audit trail, and deletion protection. Always inspection-ready.